Economy ∙ Small Business

A People’s Bank of New York

Goals

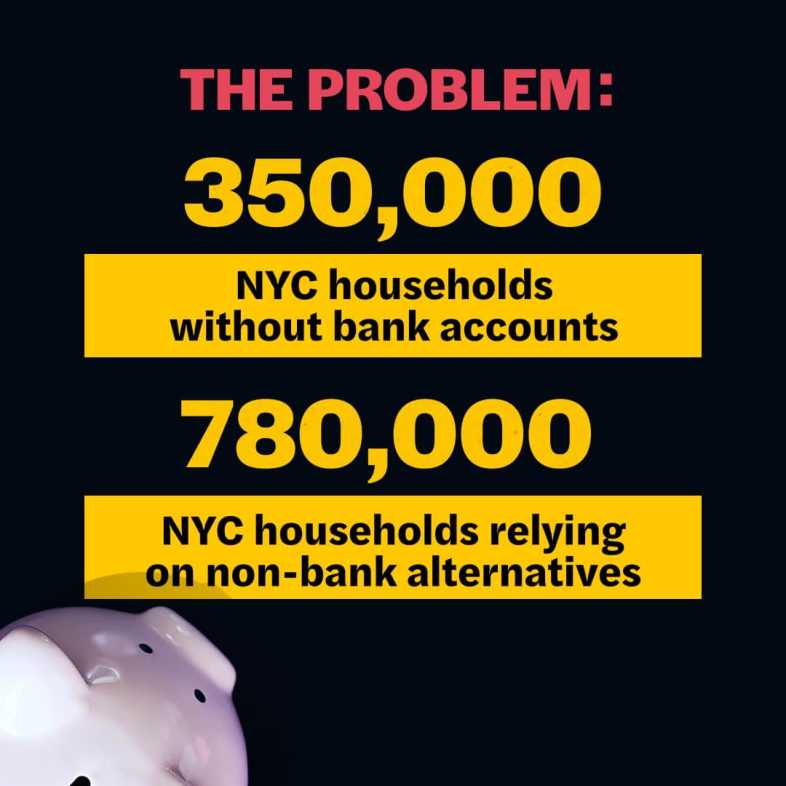

Our City faces a crisis in banking accessibility. New York City is the world’s leading financial center. Yet over 350,000 City households — almost 12% — have no bank account. That is 50% higher than the national average. Another 780,000 City households are underbanked, meaning they have a bank account but still rely on nonbank providers of alternative financial services (AFS) such as check-cashing services, prepaid debit cards, and high-interest loan services. Households that rely on such services pay high fees for even basic financial transactions — an average of over $600 per year just to cash checks.

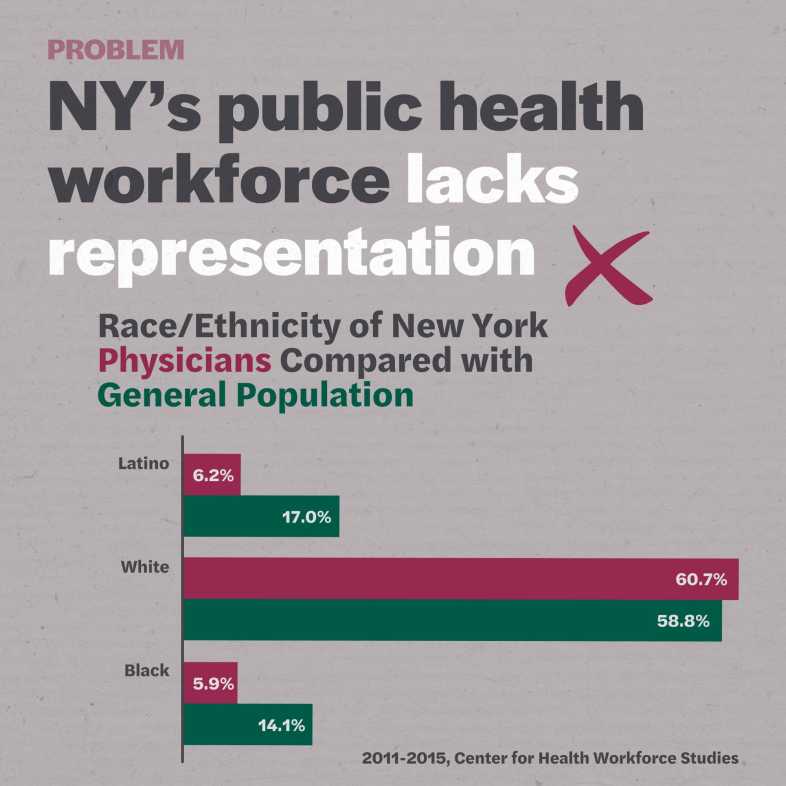

Simply put, being unbanked is an extra tax on workers and families that is imposed disproportionately on people of color living in low-income neighborhoods.

Being unbanked carries other, less obvious costs. Customers using AFS products rarely build credit, which is essential for accessing fair loans, credit cards, and rental leases. Being unbanked also disincentivizes saving since AFS costs rise quickly when consumers try to save larger sums of money. And during a pandemic, being unbanked can be physically dangerous, since you can’t cash a check remotely.

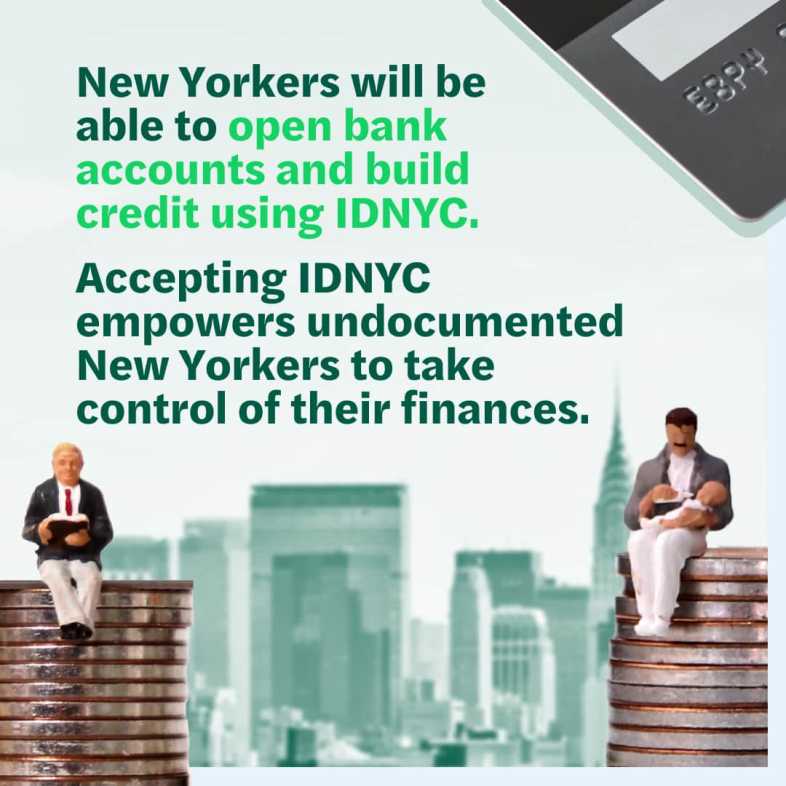

But expanding bank access is no simple task. That’s because a wide range of obstacles keep New Yorkers from using bank services. For example, some households, particularly undocumented ones, lack the identification needed to open accounts. In other cases, banks’ high overdraft fees discourage low-income workers from using checking accounts. Mainstream banks often have few branches in low-income neighborhoods, where they struggle to operate profitably.

At the same time, there are stark racial and income-based disparities in how entrepreneurs access capital. Low-income entrepreneurs often struggle to access financing to launch or grow businesses because, by banks’ conventional credit metrics, they appear to be higher risk. That’s one reason that while 22% of New Yorkers are Black, only 2% of small businesses in the City are Black-owned.

To address these challenges, a Yang administration will launch the newly created People’s Bank of New York City. The People’s Bank of New York City will be initially funded with a $100 million loan from New York City.

The People’s Bank has two objectives: (1) ensure every New Yorker can access basic financial products and services, like checking accounts, and has the opportunity to save money affordably, build credit, and secure small business loans; and (2) Support small business lending in underserved communities by guaranteeing loans and loan portfolios.

The People’s Bank will complement the work of existing Community Development Financial Institutions (CDFIs). These credit unions, community banks, minority depository institutions (MDIs) and loan funds already know the needs of the neighborhoods in which they operate and have built strong relationships of trust over many years.

The People’s Bank can be launched by New York City without new state legislation. By launching the People’s Bank early in his Mayoral Administration, Andrew Yang will build the case for a true public chartered bank that can ultimately offer a broader range of direct financial services both to the City of New York and to its people.

Activities

Specifically, the People’s Bank will:

Expand access to banking services by:

- Providing growth capital to CDFIs which they can use to offer a larger range of services in more neighborhoods at better costs.

- Launching an Innovation Lab to arm CDFIs with best-in-class financial technology and bring the benefits of fintech products, like mobile-first banking, to more consumers.

- Creating a new People’s Bank certification for financial institutions in New York City that offer basic banking services with appropriate guardrails and commit to accepting NYC ID for purposes of opening accounts.

Increase small business lending to underserved communities by:

- Providing loan guarantees for traditional small business loans originated by CDFIs.

- Partnering with CDFIs and mission-oriented technology companies to extend micro-loans under $50,000 to entrepreneurs that would otherwise be unable to access financing.

This model incorporates best practices from other programs. For example, the Bank of North Dakota, the only state-run bank in the United States, has used this method to foster the densest community-banking network in the country.

Finally, Mayor Yang will direct his Administration to encourage recipients of benefit payments — starting with Universal Basic Income (UBI) checks — to open certified “safe” bank accounts and activate direct deposit immediately. Certified safe accounts come with no overdraft penalties and other benefits and are already available from more than half the nation’s banks. At virtually no cost, the City can intentionally use its role as a disburser of benefits to drive greater financial empowerment.

Benefits for Community Institutions

Community institutions are at the forefront of our City’s fight for financial inclusion. A Yang Administration will support them, not compete with them.

Growth Capital: Loans and loan guarantees by the People’s Bank will help CDFIs get the funds they need to grow and expand. This support is all the more important under COVID-19, which has stalled small-business lending markets and dried up banks’ revenues.

Discounted retail space: Where possible, the People’s Bank will also work with the City’s other agencies to offer discounted or free rents to CDFIs that want to open new branches in underserved neighborhoods programs and similar services for disadvantaged New Yorkers.

Technical support: Technical support made possible by the People’s Bank will ensure CDFIs have the best tools, technology, and business plans which will help them attract new customers and expand operations.

CDFIs offering high-quality products will also receive People’s Bank certifications, deepening the trust their community places in them.

In sum, the People’s Bank of New York City will contribute to a vibrant, community-focused financial ecosystem that benefits workers and families, entrepreneurs and small businesses, and CDFIs alike.

See the full People's Bank of New York whitepaper here.